Key takeaways:

- AI & the energy awakening: Global energy demand is surging again after decades of stagnation, driven by electrification (EVs, heat pumps, industries...) and AI’s electricity appetite.

- The grid under strain: Data centers are stress-testing outdated grids, driving up local electricity prices and forcing utilities to innovate with solutions like virtual power plants and energy efficiency.

- Energy becomes tech’s new frontier: Hyperscalers like Google, Amazon, Microsoft, and Equinix are investing directly in clean energy—from geothermal and microgrids to nuclear micro-reactors—to secure power and drive decarbonization.

- It's affecting industries beyond electricity: Partnerships such as Microsoft x Sublime Systems and Crusoe x Redwood Materials show how AI’s growth drives cleaner materials, recycling, and resource efficiency across hard-to-abate sectors.

AI’s global share of venture capital has skyrocketed in 2025. According to CB insights, funding to AI startups hit $47.3 billion in H1, that’s 52% of VC funding worldwide. But while AI’s hogging all the headlines and attention (and sparks bubble debates), a quieter revolution is unfolding beneath the surface… According to Bloomberg, clean technology companies that have inked deals to support data centers have seen their stocks soar this year, outperforming the S&P 500. Meaning AI’s appetite for electricity is transforming the energy landscape.

The energy sector reawakens

For decades, energy demand in the U.S and Europe was flat. That era has now ended. AI, alongside EVs, heat pumps, air conditioning, industrial electrification and more, are all adding to the load. Training large language models and operating advanced data centers requires massive and continuous power.

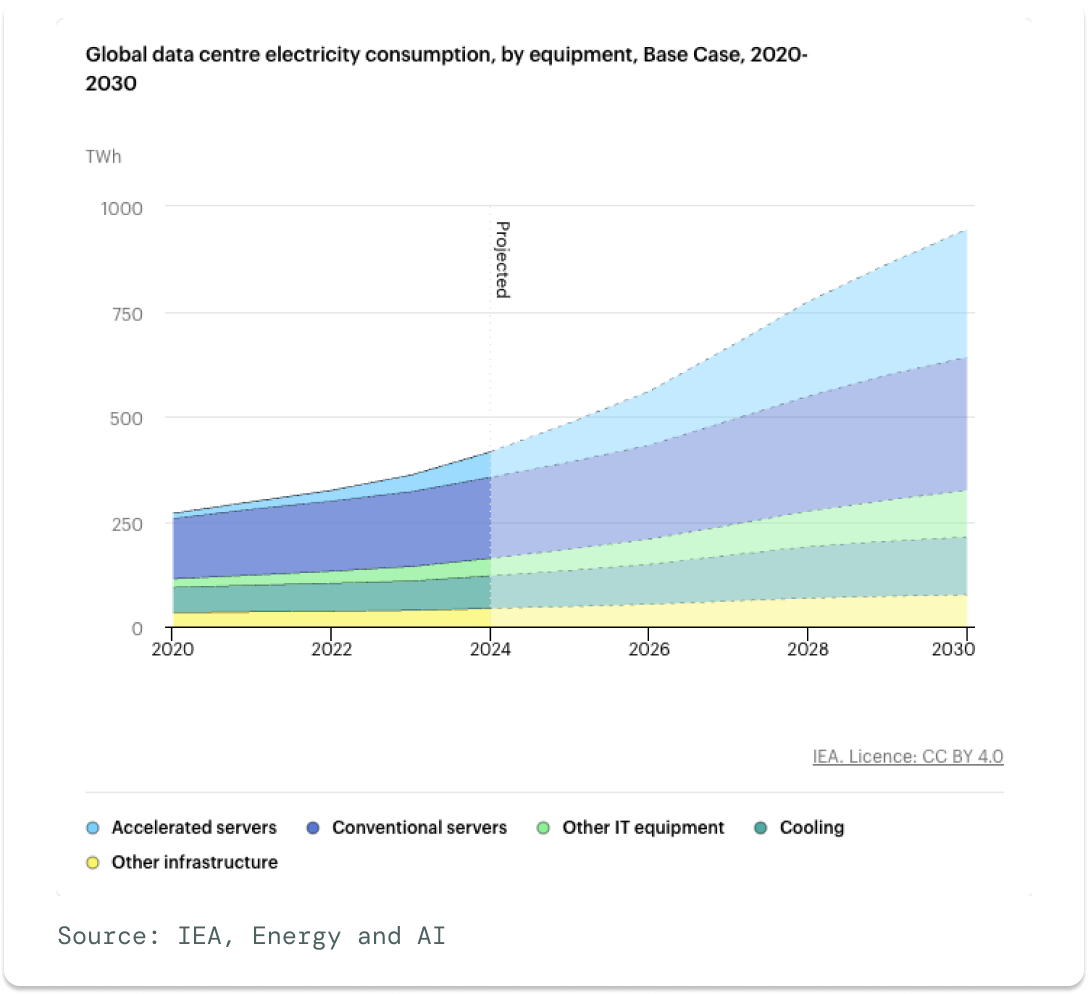

IEA’s forecast shows that electricity use from data centers is expected to double by 2030, reaching about 945 terawatt-hours (TWh). Moreover, from 2024 to 2030, data center electricity use is set to grow about 15% each year. That’s over 4x faster than electricity use in other sectors.

Still, it’s important to remember that even with this rapid growth, data centers will only make up a small share (3%) of all electricity use worldwide.

AI isn’t creating the electricity challenge (EVs, heat pumps, air conditioning, industrial electrification and more are all adding to the load anyway); it’s revealing and exacerbating it. AI and electrification are essentially injecting new momentum in a sector that hadn’t seen real growth or innovation in decades and igniting long-overdue conversations about how to build energy systems that can keep pace.

The grid under pressure

AI’s rapid build-out of new energy infrastructure is stress-testing the grid and exposing how underinvested and inflexible our current power systems are. When tech giants move their data centers into a new market, they can soak up gigawatts of power capacity, leaving utilities and grid operators scrambling to expand infrastructure quickly enough to prevent blackouts. The build-out is pushing up local electricity prices in regions near data center hot spots. Like Baltimore in the U.S, where Bloomberg recently reported up to 125% increase in wholesale electricity prices over 5 years.

This is sparking public frustration and putting pressure on hyperscalers to become more resource-efficient and flexible in how and when they use electricity. It is also forcing utilities to find ways to get more energy out of existing assets, for example, through greater energy efficiency and virtual power plants, to avoid the need for new and expensive fossil infrastructure.

Energy becomes the new tech frontier

This pressure, in combination with renewables now being both cheaper and faster to build than fossil fuel infrastructure (speed to power is the most important metric for datacenter developers), has become a catalyst for clean energy technologies and grid software. We are seeing hyperscalers such as Google, Amazon, and Microsoft, parties with enormous financial resources, now actively investing in the energy sector (and beyond).

Together with their data center developers, they are investing in both proven and next-generation clean technologies to power their operations and create more flexible energy systems. For example, by committing to long-term offtake agreements, they are helping to reduce the risk for early-stage innovations that might otherwise struggle to scale, sending a powerful signal of trust to the broader market.

We see this across our portfolio too:

- 🌋 Google partnered with Fervo Energy, over 4 years ago already, to bring online a “first-of-its-kind” enhanced geothermal power project in Nevada that is now supplying carbon-free electricity to the local grid that serves Google’s data centers. Their partnership offered a roadmap and template for how corporates and utilities can collaborate (via new structures like the “Clean Transition Tariff”) to accelerate deployment of advanced clean technologies.

- 🌋 Meta announced a 150 MW next-generation geothermal partnership with XGS Energy in Mexico. This partnership enables XGS to deliver its first large-scale project, serving as proof of concept while reducing technology, permitting and financing risks for future projects. Few companies are willing to take on this first-of-a-kind risk, which makes the partnership particularly valuable..

- ⚡️ Amazon is an investor in Mainspring, backing flexible microgrid generators that can run on renewable fuels (critical for grid resilience). The generator can switch among biogas, hydrogen, or ammonia (and potentially other low- or zero-carbon fuels) without major hardware changes. That flexibility mitigates the risk of technology lock-in.

- ☢️ Equinix (global data center developer and operator) signed deals with Radiant Industries and pre-ordered 20 units of compact nuclear micro-reactors for its global data-center footprint. Recently, Radiant has announced plans to build a dedicated factory in Oak Ridge, Tennessee (on a historic Manhattan Project site) that will mass-produce its “Kaleidos” micro-reactors. Construction is slated to begin in early 2026.

These are not isolated bets; they reflect a new playbook where digital infrastructure and clean energy can co-evolve. By anchoring demand for new technologies, hyperscalers can help underwrite the next wave of the energy transition. In return, they reap the long-term benefits of energy security, cost stability, and faster permitting for new sites.

The ripple effect: beyond electrons

AI’s infrastructure build-out is also affecting industries beyond electricity. Every computing decision (from chip design to server cooling) creates cascading effects across materials, manufacturing, and supply chains. It is driving decarbonization across sectors considered hard to abate, including steel and cement. By securing low-carbon materials early, companies lock in scarce supply, hedge against future carbon costs, and streamline regulatory approvals, especially in Europe, where sustainability performance is tightly linked to site access and permitting speed.

Again, this is reflected in our portfolio:

- 🧱 Sublime Systems signed a binding, long-term purchase agreement with Microsoft for ~622,500 metric tons of clean cement. An interesting component: Microsoft will have the priority option to purchase not only the physical low-carbon cement material but also the environmental attribute certificates (EACs) tied to that material (separate from the concrete itself), using a “book & claim” model to decouple the geography of supply from usage. The use of EACs for cement is similar to how clean energy credits work in the power sector. This mechanism can help overcome geographic or logistical constraints and create a new market structure in heavy materials.

- ⚙️ Hyperlume builds microLED-based optical interconnects that help data-centers gain efficiency across the entire energy stack and thus reduce power consumption. Hyperlume just had a successful exit to Credo. Often, when we think of clean energy, we focus on generation. But the demand side efficiency is equally crucial. By improving the way data is moved and processed, we can limit the enormous energy needs of AI.

- ♻️ Crusoe and Redwood Materials are partnering to close the loop on energy storage and address supply chain bottlenecks. Together, they will deploy a large-scale micro-grid using second-life EV batteries to power modular AI data-centers. The installation (12 MW solar + 63 MWh of repurposed EV batteries) at Redwood’s campus in Nevada is the largest second-life battery deployment in North America and powers Crusoe’s “Crusoe Spark” modular AI data-center units.

Together, these examples show how AI’s growth is accelerating decarbonization far beyond energy generation and pushing for rethinking efficiency, repurposing resources, and reshaping material flows.

The road ahead

Whether the AI boom continues or not, one thing is certain: the world will need far more clean electricity and better grid infrastructure to electrify our economy. The rapid growth of AI is now bringing many ideas that were long at the margins of the power sector back to the forefront. Distributed energy resources, grid flexibility, long-duration energy storage, geothermal energy, nuclear and even new approaches to market design are now seen as central to the future of the energy system.

In many ways, the datacenter buildout and financial firepower of hyperscalers has acted as a catalyst for commercializing innovations in the energy sector, accelerating conversations and investments in climate technologies that had long been overdue.